When you walk into a clinic or urgent care center, you rarely think about how much the medications cost the provider. But for those running these practices, the price of everyday generics - like amoxicillin, lidocaine, or metformin - can make or break their bottom line. That’s where bulk purchasing comes in. Buying large quantities of off-patent drugs isn’t just a cost-cutting trick; it’s a strategic move that’s reshaping how small and mid-sized providers manage their drug budgets. And the savings? They’re real, often hitting 20% or more.

How Bulk Buying Works for Generic Drugs

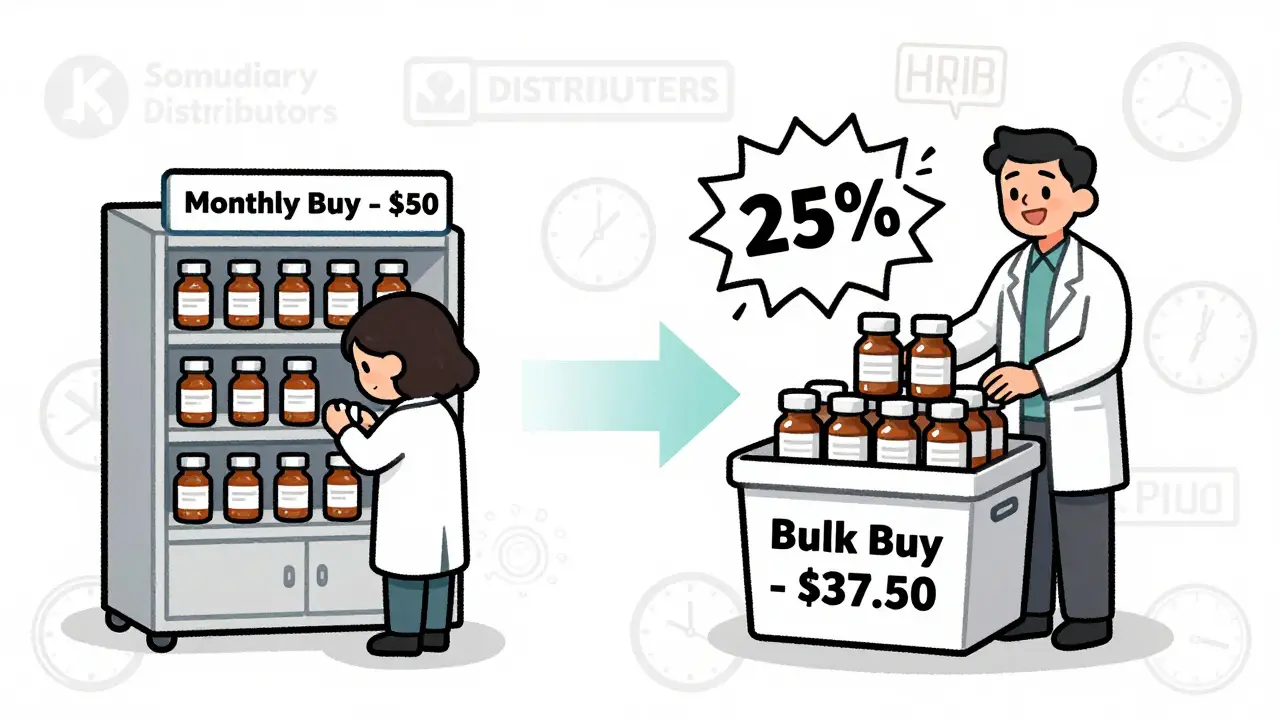

Generic drugs are the backbone of modern healthcare. They make up 90% of all prescriptions filled in the U.S., yet they account for just 25% of total drug spending. Why? Because they’re cheap to produce - but not always cheap to buy. The real cost savings don’t come from the manufacturer’s price tag. They come from how you buy them. Bulk purchasing means ordering large volumes - often 1,000 to 10,000 units at a time - to unlock volume-based discounts. These aren’t random deals. They’re structured through formal agreements with distributors. For example, ordering 1,000 vials of lidocaine might get you a 10% discount off the invoice. Order 10,000? That jumps to 25%. The bigger the order, the bigger the cut. This isn’t just about squeezing suppliers. It’s about leveraging scale. Think of it like buying toilet paper in a warehouse pack instead of a single roll. The per-unit price drops because the seller moves more product at once. In healthcare, that math adds up fast. A small urgent care clinic spending $5,000 a month on generics could save $1,000 a month just by switching to bulk orders for their top five medications.The Players Behind the Discounts

Not all distributors are created equal. There are three main types:- Primary wholesalers - McKesson, AmerisourceBergen, and Cardinal Health. They control about 85% of the market and typically offer discounts of only 3-8% for bulk orders.

- Secondary distributors - like Republic Pharmaceuticals. These are smaller, more agile players who focus on niche markets. They often offer 20-25% discounts by buying in bulk themselves and reselling at lower prices. They’re especially good at sourcing short-dated stock - drugs that are still safe to use but have six to twelve months left before expiration.

- Pharmacy Benefit Managers (PBMs) - These are the middlemen between insurers and pharmacies. They negotiate rebates with manufacturers, sometimes as high as 40%. But here’s the catch: they don’t always pass those savings on. Studies show only half to 70% of PBM rebates actually reach the provider or patient.

Short-Dated Stock: The Hidden Goldmine

One of the smartest tricks in bulk purchasing is buying short-dated stock. These are medications that are still perfectly safe and effective, but their expiration dates are coming up. Manufacturers and wholesalers want to move them before they expire - so they slash prices. Discounts range from 20% to 30%. The catch? You need good inventory management. If you order too much and don’t use it before it expires, you lose money. But if you plan right, you can save big without risking patient safety. Take a dermatology practice that uses 300 vials of cortisone injections per month. If they switch from ordering monthly (at full price) to ordering three months’ worth at a time from a secondary distributor offering 25% off short-dated stock, they’re saving $2,250 a month on just one drug. That’s $27,000 a year. And if they’re using the drug consistently, they’ll use it all before it expires. Clinics that track their usage patterns closely - using simple spreadsheets or EHR-integrated tools - report 95-98% utilization rates for short-dated stock. That means almost nothing goes to waste. The key is matching your order size to your usage, not just grabbing the biggest discount.

Multi-State Pools: When Governments Buy Together

It’s not just clinics and hospitals doing bulk buying. State Medicaid programs have been pooling their purchasing power for years. Programs like the National Medicaid Pooling Initiative (NMPI), the Top Dollar Program (TOP$), and the Sovereign States Drug Consortium (SSDC) let multiple states buy together to get better deals. Individually, a single state might get a 1-2% discount on generics. But when 20 or 30 states combine their orders, they can lock in 3-5% savings. That might sound small, but multiply it by billions in drug spending, and you’re talking tens of millions saved annually. These pools don’t just help Medicaid. Many private providers can join them too - especially if they’re part of a larger network or association. The National Pharmaceutical Discount Consortium (NPDC), for example, facilitates over $800 million in annual purchases for more than a million people.Where Bulk Buying Falls Short

Bulk purchasing isn’t magic. It doesn’t work for everything.- Low-use drugs - If you only prescribe one or two doses of a drug per month, buying in bulk is a waste. You’ll end up with expired stock.

- Drug shortages - In late 2023, the FDA tracked 298 active shortages of generic drugs. If you’re locked into a bulk order and the supply chain breaks, you’re stuck.

- Minimum order requirements - Some distributors require you to buy 5,000 units of a drug just to get the discount. If you don’t need that many, you’re forced to over-order - which ties up cash and creates storage headaches.

What’s Changing in 2025

The rules are shifting. The Inflation Reduction Act’s Medicare drug price negotiation program is starting to take effect. In 2026, the government will negotiate prices for 10 high-cost drugs - with projected savings of 38% to 79% off list prices. That’s a game-changer. Meanwhile, PBMs are rolling out integrated point-of-sale discounts. No more separate discount cards. When a patient fills a prescription for metformin or atorvastatin, the lower price kicks in automatically - because the PBM already negotiated the bulk deal behind the scenes. The FTC is also cracking down on price manipulation. With 17 active investigations into drug pricing practices as of late 2023, the days of opaque rebate systems may be numbered. Transparency is coming - and that means providers will have clearer insight into who’s really saving what.How to Start Bulk Purchasing (Step by Step)

If you’re a provider looking to cut generic drug costs, here’s how to begin:- Identify your top 15-20 drugs - Look at your prescription data. Which generics do you use most? These are your targets.

- Calculate your monthly usage - How many units do you use per month? Multiply that by 3-6 months to get your ideal bulk order size.

- Reach out to secondary distributors - Companies like Republic Pharmaceuticals specialize in bulk generics. Ask about their short-dated stock, minimum order requirements, and discount tiers.

- Start with one drug - Don’t overhaul everything at once. Test with one high-volume item, like amoxicillin or saline solution.

- Track expiration dates - Use a simple spreadsheet or EHR module to flag drugs with six months or less until expiration. Use them first.

- Review monthly - After three months, check your savings. Did you waste any stock? Did you run out? Adjust your order size accordingly.

Final Thoughts: It’s Not About Cheaper Drugs - It’s About Smarter Buying

Bulk purchasing doesn’t mean you’re compromising on quality. The generics you buy are FDA-approved, identical to brand-name drugs in strength, safety, and effectiveness. The difference is in how you acquire them. The real win isn’t just the discount. It’s control. When you buy bulk, you’re not at the mercy of unpredictable price hikes or allocation limits. You’re making informed decisions based on your actual usage - not what a distributor tells you to buy. As drug pricing pressures grow, the providers who thrive won’t be the ones with the biggest budgets. They’ll be the ones who know how to buy smart.Is bulk purchasing safe for patients?

Yes. Generic drugs bought in bulk are identical to brand-name drugs in active ingredients, dosage, safety, and effectiveness. They’re approved by the FDA through the same rigorous process. Even short-dated stock - drugs with six to twelve months left before expiration - is fully safe to use. The only risk is if inventory isn’t tracked properly, leading to expired medication. Proper management eliminates this risk.

Do I need special software to manage bulk purchases?

You don’t need expensive software, but you do need a system. Many clinics use simple spreadsheets to track usage and expiration dates. More advanced practices integrate bulk purchasing data into their electronic health records (EHRs) to auto-flag low stock or upcoming expirations. The goal is to match your order size to your usage - not guess.

Can small clinics benefit from bulk purchasing?

Absolutely. In fact, small clinics benefit the most because they’re often overpaying due to small, frequent orders. A clinic that orders 50 units of amoxicillin every week pays more per unit than one that orders 600 units every three months. Secondary distributors like Republic Pharmaceuticals cater specifically to small practices, with minimum orders as low as 100-500 units.

Why do PBMs offer big discounts but don’t pass them all on?

PBMs negotiate rebates with drug manufacturers based on how much of a drug they push through their networks. The rebate is paid to the PBM, not directly to the provider or patient. Some PBMs keep a large portion of that rebate as profit, while others pass it along. This lack of transparency is why many providers now bypass PBMs entirely and buy directly from secondary distributors.

What happens if a drug goes into shortage after I’ve bought in bulk?

If a drug shortage hits, you may not be able to replace your supply - but you won’t lose the stock you already have. In fact, having bulk inventory during a shortage can be a huge advantage. The key is to avoid over-ordering on drugs that are already in short supply. Monitor the FDA’s Drug Shortage Database and avoid committing to large orders on drugs flagged as “in shortage.”

How long does it take to see savings from bulk purchasing?

Most providers see savings within 30-60 days after switching to bulk purchasing. The first month is usually spent setting up new supplier relationships and adjusting order schedules. By the second or third month, you’ll have a clear view of your cost reduction. One clinic reported saving $1,200 in the first month on just three drugs after switching to a secondary distributor.

Hanna Spittel

January 1, 2026 AT 09:42short-dated stock is literally just expired meds with a new label 😂

Deepika D

January 1, 2026 AT 14:02Let me tell you something - I run a small clinic in rural India and this whole bulk purchasing thing changed everything. We were paying $12 a vial for metformin? Now we get 500 units at a time from a secondary distributor for $7.50. That’s a 37% drop. And guess what? The pills are identical. Same FDA stamp, same batch code, same everything. We track expiration dates with a simple Google Sheet. No fancy software. Just discipline. We’ve saved over $8,000 last year just on three drugs - amoxicillin, lidocaine, and saline. And yes, we’ve had a few close calls with short-dated stock - but we use it fast. We’re not hoarders, we’re smart. If you’re a small clinic thinking this isn’t for you - it’s exactly for you. Stop buying weekly. Start buying quarterly. Your budget will thank you. And your patients? They get the same meds, just cheaper. No magic. Just math.

John Chapman

January 3, 2026 AT 11:00THIS IS THE MOST IMPORTANT THING YOU’LL READ THIS YEAR 🚨💸

Stop letting PBMs rob you blind. Secondary distributors are the real MVPs. I switched last year and my injectables bill dropped 40%. I didn’t even know short-dated stock was a thing. Now I’m literally hoarding cortisone vials like they’re gold. 🤑 And yes, I’ve got a spreadsheet that looks like a NASA mission control dashboard. But guess what? I’m saving $3k/month. Who cares if it’s not pretty? It’s WORKING. If you’re not doing this, you’re leaving money on the table. And that’s not just bad business - it’s unethical. Patients deserve affordable meds. We owe it to them to be smart. #BulkBuyingIsTheFuture

Branden Temew

January 3, 2026 AT 21:24So let me get this straight - we’re celebrating how pharmacies are exploiting loopholes in a broken system to save pennies on pills, while the real villains - the manufacturers, the PBMs, the lobbyists - sit back laughing? The fact that we need to hunt down ‘short-dated’ drugs like treasure hunters just to afford basic medicine… that’s not innovation. That’s desperation dressed up as strategy. The system is rigged. Bulk buying is just a Band-Aid on a hemorrhage. And yet, here we are, high-fiving over 25% off amoxicillin like it’s a win. The real win? When the government negotiates prices - not when we scramble to buy expired meds before they expire. We’re not solving the problem. We’re just getting better at surviving it.

Urvi Patel

January 4, 2026 AT 22:49Wow so you mean to tell me small clinics can save money by buying in bulk? How revolutionary 🤡

Meanwhile in the real world where people actually understand supply chains - pharmaceutical giants have been doing this for decades. You think you’re clever? You’re just catching up to what multinational corporations have optimized since the 90s. And don’t get me started on secondary distributors - those are the same guys who sell you expired insulin from a warehouse in Ohio and call it ‘value’. You’re not being smart. You’re being exploited by middlemen who know you’re desperate. But hey - keep your spreadsheet. It’s cute.

anggit marga

January 4, 2026 AT 23:30USA thinks it invented bulk buying? LOL

In Nigeria we’ve been buying meds in bulk since the 80s because our government never paid for them. We don’t wait for secondary distributors. We go straight to the port. We don’t care about expiration dates because we use it before it expires. You call it ‘smart buying’? We call it survival. Your system is broken. We didn’t wait for an act or a study. We just did it. You’re late to the game. And now you’re making it sound like a TED Talk. Please.

Kayla Kliphardt

January 6, 2026 AT 09:40I’ve been thinking about this a lot. I’m not a provider, but I work in admin at a clinic. I’ve seen how chaotic inventory can get. I wonder - do any of you use barcode scanners or just manual logs? I’m curious if anyone’s tried integrating this with their EHR. I don’t want to overstep but… I’d love to hear what tools actually work in practice. No pressure. Just genuinely interested.

Joy Nickles

January 8, 2026 AT 05:53Okay but like… what if the PBM is ALSO the secondary distributor?? 😱 I just found out my ‘discount’ vendor is owned by the same company that owns my PBM!! So I’m paying more because I think I’m saving?? And now I’m paranoid about EVERYTHING. Like… is my lidocaine even real?? I’ve started checking batch numbers on the FDA site at 2am. I need therapy. And maybe a new supplier. Or a gun. 🤯

linda permata sari

January 9, 2026 AT 06:22My heart just skipped a beat when I read about the Ohio clinic saving 25% on injectables. I almost cried. I’ve been working in urgent care for 14 years and I’ve watched drug prices climb while our salaries stayed the same. We’ve had to turn patients away because we couldn’t afford the meds. This isn’t just about money - it’s about dignity. It’s about being able to say ‘yes’ when someone asks for help. Thank you for writing this. Not just for the data - but for the humanity behind it. You gave me hope. And I’m going to start bulk buying next week. No more excuses.